Published 2005-05-15.

Time to read: 4 minutes.

Heisenberg’s Uncertainty Principle

The Greek philosopher Democritus believed that the natural world was immutable. In 1927 Werner Heisenberg published his “Uncertainty Principle” which implied, amongst other things, that observing a quantum phenomenon also significantly altered the phenomenon. For many people, such an idea was counter-intuitive.

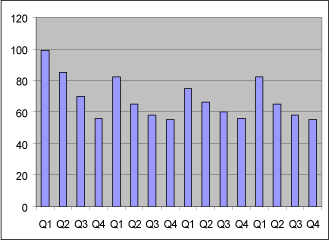

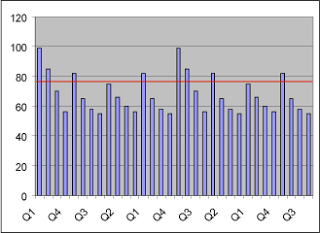

What is true in the physical realm is even more true in the realms of interpersonal relationships and business. Our beliefs and belief systems affect outcomes more than we perhaps realize. Consider the diagram below.

Describing the Trend

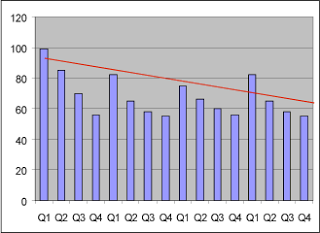

Without knowing what the diagram represents, can you postulate the trend for the next cycle or two? The answer is, of course, no. You need to have an internal model of the behavior of the system and the entity’s behavior within that system represented in the graph before you can make a prediction. Without any additional information, you might anticipate the trend like this:

Your model is based on incomplete information, and is necessarily a simplification of the actual system. If you are told that the graph depicts rainfall, and if you believe in a rain god, then your natural reaction might be to find a virgin to sacrifice. If you instead had the belief that rainfall had diminished due to clear-cutting of a vast forest which no longer acted as a natural storage mechanism for rainwater, your reaction might be to start lobbying for an intensive tree planting effort. Both belief systems have at their core a central belief that action can affect the outcome to some degree, so your prediction as to how much rain will fall in subsequent years will rely on the vigor with which countermeasures are applied, and your belief in their efficacy. Probably your belief would be that rainfall levels will tend to vary around historical norms, like this:

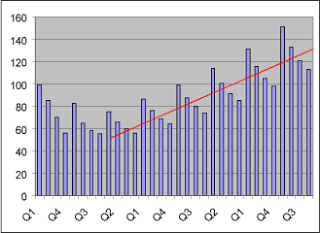

What if you were told instead that the first graph represented sales of a hybrid car model, and that ‘experts’ believed that increasing SUV sales and the economy were believed to be responsible for declining sales? A marketing campaign that addressed the rising cost of gas and promoted decreasing the reliance of the US economy on foreign oil as being truly patriotic might gain traction. One might attribute the initial sales spike as being due to purchases by early adopters. The tapering off of sales might be the result of tax incentives that artificially promoted the sales of vehicles over 6,000 pounds.

It is clear that China’s consumption of gas will soon outpace even the US’s rate of consumption, so gas prices will continue to rise, and remain at higher prices than any we have experienced to date. The US Department of Energy produced the following projection of Chinese gas consumption in June 2004.

In 2003, BP showed China’s new influence on global oil supply: “Global oil demand, meanwhile, was broadly flat, increasing 290,000 bpd to 75.7 mm bpd from 75.5 mm bpd. All the increase is attributable to China where oil consumption increased 5.8 % or 332,000 bpd.” As demand for a commodity increases, prices increase. As China continues to dramatically increase its demand for oil, prices can only continue higher. In a feature article on Alexander’s Gas & Oil Connections, John Vidal writes “China's oil consumption, which accounted for a third of extra global demand last year, grew 17% and is expected to double over 15 years to more than 10 mm bpd – half the US's present demand. India's consumption is expected to rise by nearly 30% in the next five years.” Jim Meyer, an expert at London's Oil Depletion Analysis Centre was quoted in an article last month as saying “After 2007, we can’t see enough new supplies to meet almost any reasonable level of demand growth.” Expect gas prices to permanently exceed $50/barrel, and $100+/barrel will be reached with startling speed. With that in mind, a long term sales trend for hybrid cars in the US might be projected to look like this:

This projection assumes that historical sales figures are not a significant factor when gauging future sales of this hybrid car model, and that factors on the market that the product sells into have not yet been fully felt or internalized by consumers.

Self-Fullfilling Prophecy

What if a hard-nosed automotive executive, looking at ROI on a quarter-by-quarter basis decided that the return was not immediate enough, and terminated the hybrid car based on sales history to date? That automotive manufacturer would soon miss the world’s largest market, China, as the demand for fuel-efficient cars will soon be supported by a Chinese middle class newly able to afford more expensive hybrid cars. Unless the manufacturer was somehow able to introduce another technology, such as hydrogen powered vehicles, and successfully put together a national infrastructure network to support hydrogen fuel stations, they will have traded off short-term profitability for long-term viability.

Returning to the original idea behind this articleing, one’s expectations and beliefs do color what one might think to be reasonable. If you believe that most people are kind and generous, your behavior will probably reinforce this belief – with the result that even when you meet Scrooge incarnate, he might crack a smile despite himself. If you think that sales of product XYZ are going down, down, down and that nothing can be done about it then that product is as good as dead. If instead, you come up with an alternate world view, communicate higher expectations and provide sufficient resources over the appropriate time period, that product’s best years may be yet to come.